Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

5/5

Expanding to a new market quickly and smoothly is possible with the right global expansion partner. INS Global has more than 15 years of experience helping companies set up and start easily worldwide. If you want to enter the Nigerian market without risks that could threaten your global strategy, our Professional Employer Organization (PEO) can help.

INS Global’s PEO services are available in over 160 countries, and our multinational team of experts is always working to make sure that you don’t waste any time or resources on needless expenses. A PEO can get you started in your target market in just a few days, and with an Employer of Record (EOR) you can have all administrative and legal responsibilities for your employees taken care of by professionals.

Making legal errors in a new market can result in expensive fines and penalties. With a PEO you can receive immediate legal advice and assistance from our staff and remain legally compliant every step of the way.

Bypass the usual complications and hassles of global expansion and enter new markets equipped with the personalized strategies that a PEO can provide.

A PEO handles many different tasks, including recruitment, onboarding, contractor management, and payroll, so that you can focus on bringing your company closer to its market goals.

With company incorporation, it takes months or even a year before set-up is complete. A PEO lets you start running operations in less than a week.

Through a single point of contact, you can have access to legal advisors, recruitment counselors, and long-term payroll and HR services.

Traditional company incorporation of an overseas subsidiary is a tried-and-test method of global expansion, but it often requires many lengthy and arduous procedures. A PEO allows a company to operate in full legal compliance in a new country without needing to build a separate entity first.

Other ways that a PEO can benefit you include…

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

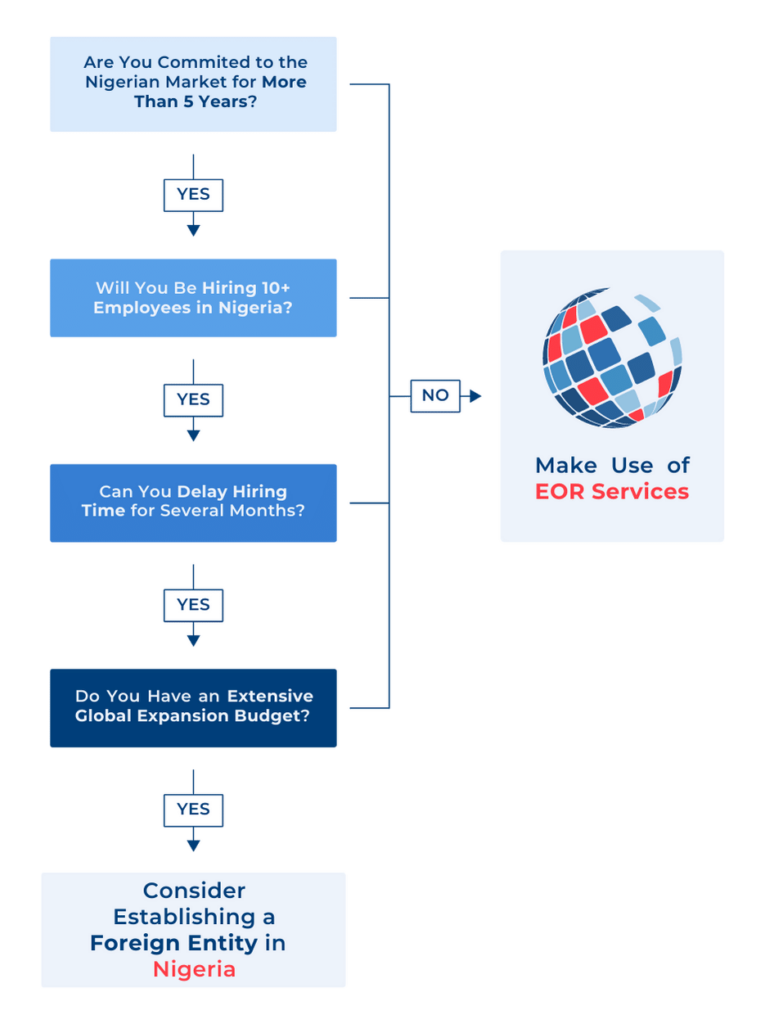

Both PEO and EOR solutions provide similar services, but they are not identical. Understanding the differences is important when you’re deciding which one would best suit your needs.

A PEO and EOR both function as third-party organizations that provide HR services to employees of other companies. These services include but are not limited to, payroll, tax, contract compliance, and more.

One crucial distinction is that an EOR legally hires employees on behalf of other companies. An EOR then becomes responsible for all the liabilities and employer responsibilities of these employees.

Another difference is how the contracts are made. In a PEO agreement, the contract remains between the client company and the employee. In an EOR agreement, however, the contract is directed by the client company but made directly between the EOR and the employee.

Handling payroll for the staff of a non-profit organization (NPO) or other NGO (Non-Governmental Organization) type companies is not the same as regular employees. Moving to a new market can be even harder when overwhelmed with new laws and regulations. Non-profit organizations and their employees typically fall under a different category and have unique tax requirements. As an organization dedicated to helping others, you want to make sure your time and resources aren’t spent on having to pay non-compliance fees or fines for legal errors.

A PEO has a legal team that can safely take care of your legal responsibilities. A partner like this can also assist with global recruitment, payroll for new staff and volunteers, and making connections between local businesses and communities. We handle all your expansion needs so that you can help those in need.

Written employment contracts are required in Nigeria. The official language for legal documentation in the country is English. As a result, contracts should be written in English and compensation amounts in the local currency of Nigeria naira.

Probation periods are typically from 3-6 months.

Notice periods vary in Nigeria based on the length of service with a company but vary from 1 day of notice after 3 months of service to 1 month of notice after 5+ years of service. In Nigeria “at-will employment” can be applied to contracts, meaning both employer and employee can terminate their work contract without providing a reason. However, if the employer chooses to fire an employee immediately, in place of notice, the employer must provide the employee with an amount of compensation equivalent to the missing notice days.

Severance pay is not automatically mandated by law but is usually specified in the contract.

A standard work week in Nigeria is 40 hours. Maximum weekly hours and specific overtime rates for industries and companies are determined by collective bargaining agreements (CBAs) and written contract agreements.

The national minimum wage is NGN30,000 per month.

There are at least 8 public holidays recognized across Nigeria. However, certain regions celebrate specific significant dates, and there are also Islamic holidays so the total number of public holidays each year can be upwards of 13.

If a holiday lands on a weekend it is not shifted to another date.

Overtime pay for those who are required to work on holidays is 200% of regular wages.

Employees who have worked in a company for a minimum of 12 consecutive months are eligible for 6 days of paid leave. Employees under the age of 16 receive 12 days of paid leave.

Unused annual leave can be accrued for up to 24 months

Annual sick leave is 12 days at full pay. A medical certificate or doctor’s note must be provided.

Expectant mothers receive 12 weeks of maternity leave, 6 before birth and 6 after. Employees who have worked a minimum of six continuous months are entitled to receive at least 50% of their wages during maternity leave.

Paternity leave is not mandated and can be decided by contract or may be required because of a CBA.

Corporate tax is charged according to the size of the company’s gross turnover. It starts at 0% for companies with a gross turnover of NGN25 million or less. It goes to 20% for companies that make more than 25 million but less than 100 million. Large companies that make more than 100 million are taxed at 30%.

VAT is 7.5%.

Income tax is calculated at a progressive rate from 1-24%.

Residents of Nigeria are taxed on their worldwide income.

Foreign residents are taxed if their income comes partly or entirely from employment in Nigeria, unless tax treaties specify otherwise. Details of these can be found here.

Sub Title Slider 4

VIEW DETAILS

Sub Title Slider 3

VIEW DETAILS

Sub Title Slider 1

VIEW DETAILS

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

Level 39, Marina Bay

Financial Centre Tower 2,

10 Marina Boulevard

Singapore 018983