- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Hassle free global hiring without an entity,

with a partner always looking out for you.

We know the challenges of expanding globally and locally, integrating seamlessly with the nuances of a new market.

With nearly two decades of experience, we’ve learned that business success requires both intimate attention and an approach based upon quality over quantity. Rapidly expand across 160+ countries with our proprietary AI-driven Employer of Record platform, stream lined centralized invoice system, and team of experts ensuring complete local regulatory compliance.

Be up and running in brand new markets within days and streamline billing with just a single invoice each month.

Enjoy friendly, responsive and unparalleled guidance every step of the way. Every solution, always compliant.

We’ve garnered 15+ years of experience and the trust of hundreds of companies because we do it right.

We know the challenges of expanding globally and locally, integrating seamlessly with the nuances of a new market.

With nearly two decades of experience, we’ve learned that business success requires both intimate attention and an approach based upon quality over quantity. Rapidly expand across 160+ countries with our proprietary AI-driven Employer of Record platform, stream lined centralized invoice system, and team of experts ensuring complete local regulatory compliance.

Pay Globally

Around the Globe

Build your global teams in all 50 United States and in 160+ countries with our full stack of expansion solutions.

Expand effortlessly with cutting edge tech solutions and award winning customer service.

Build your global teams in all 50 United States and in 160+ countries with our full stack of expansion solutions.

Expand effortlessly with cutting edge tech solutions and award winning customer service.

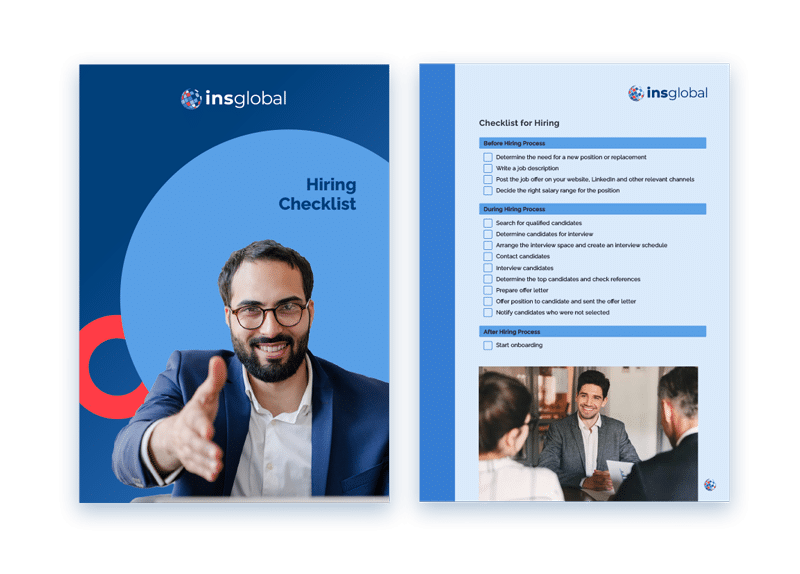

https://ins-globalconsulting.com/wp-content/uploads/2022/07/INS-Global_Hiring-checklist-v.3.pdf

Manuel Ramos

TERAO ASIA

Director General

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.