Employer of Record in Luxembourg & PEO

Hire Globally, Pay Locally, Expand Effortlessly

A PEO is an efficient way to hire and manage HR for employees overseas without going through the hassles of setting up a new branch in the target market.

For companies wishing to hire and manage crucial HR functions in overseas target markets in as little as 48 hours, a PEO (Professional Employer Organization) offers a simple and secure path to total global mobility.

INS Global offers a PEO in Luxembourg service combining expertise and experience for internationally expanding companies.

As a third-party organization that takes on the responsibilities of an employer, an Employer of Record (EOR) in Luxembourg provides companies with a cost-effective and simple solution for the complications of overseas hiring and employee management.

INS Global offers EOR services for companies looking to streamline the complexities of global mobility.

Employer of Record in Luxembourg & PEO - Summary

Employer of Record in Luxembourg & PEO

What are the Advantages of Using a PEO as your Local Partner in Luxembourg?

Expert Guidance on All Legal Matters

PEOs provide specialist knowledge of relevant labor regulations to assure you of total compliance

Get Started in a Fraction of the Time

A PEO can allow you to begin operations in a new country in a matter of days, which is ahead of the months it can take to establish a new entity via company incorporation

Simplify Your Setup Process

PEOs allow you to operate in a way that gives you greater flexibility in the way you hire and provide for your employees

Reduced Spending on Costly Local Necessities

Save on salary, benefits, and other costs like office space in Luxembourg

Enjoy All the Services You Need Through One Point of Contact

A PEO gives you the operational capabilities of an entire team or department for a single monthly fee, with no additional management time requirements.

What Does a PEO Provide Over Company Incorporation in Luxembourg?

Incorporating a new company overseas can be burdensome and costly. If you are unfamiliar with labor regulations in your target market, you could face expensive fines and penalties for the slightest errors in HR.

- Allows you to expand confidently without fear of costly fees

- Provides expert advice and guidance on local labor benchmarks and best practices

- Increases market entry time

- Decreases the cost of overheads and expenses in Luxembourg

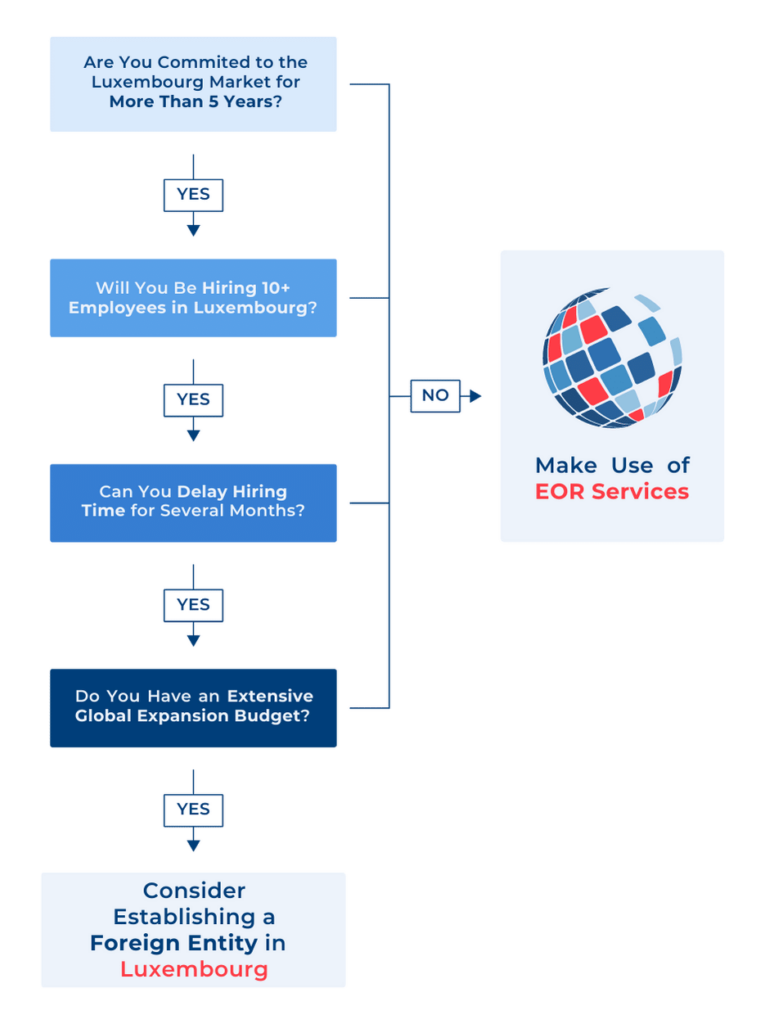

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

4 Steps Required to Begin Working with a PEO in Luxembourg

- We meet to discuss your needs and form an agreement that suits you

- Our PEO in Luxembourg provides you with a way to quickly and securely transfer or hire employees to the country

- We take care of all necessary HR services for you and your employees

- You and your staff continue operations as normal

Do PEOs (Professional Employer Organization) and EORs (Employer of Record) Differ in Luxembourg?

These two options provide many of the same services but there are differences in how they offer them.

- A PEO acts as your partner in Luxembourg, providing HR services for your employees through a contract made with your company.

- An EOR legally and officially hires your employees in Luxembourg on your behalf, providing all employment services (including HR) via a contract made directly with the employee (as directed by you).

INS Global offers both these services in Luxembourg, so you can choose the one that best suits your needs.

Labor Law in Luxembourg - 2024 updated

Employment Contracts in Luxembourg

Most contracts in Luxembourg are for indefinite periods and must be made in writing. Fixed-Term contracts may be made for specific short-term periods.

There is a guaranteed minimum wage in Luxembourg, based on age and worker type.

Work Hours and Overtime in Luxembourg

Regular working hours are 8 hours per day and 40 hours per week. Any amounts above this must be established in writing with a specific reason given and can only be for a short time.

Maximum working hours, including overtime, must not exceed 10 hours per day or 48 hours per week. These overtime hours are to be paid at 140% of the standard salary.

Holidays and Annual Leave in Luxembourg

There are 11 days of public holiday per year in Luxembourg. Employers must allow workers a day off on these holidays or pay 200% of their standard salary. The legal minimum amount of annual leave a worker is entitled to in Luxembourg is 25 days.

Sick Leave in Luxembourg

Workers in Luxembourg must provide employers with a medical incapacity certificate by the third day if they want to take sick leave and are protected against dismissal for 26 weeks.

Employers are obliged to pay employees on sick leave until the end of the month in which the 77th day of sick leave occurred. After which time, the employee is eligible to receive an allowance based on social security contributions.

Maternity and Paternity Leave in Luxembourg

Female employees are eligible for maternity leave that begins 8 weeks before the due date of a child and lasts a maximum of 20 weeks (with additional leave for late births).

During this time, employees may receive an allowance based on their standard salary but limited to 5X minimum wage.

Male employees are eligible for 10 days of paid paternity leave upon the birth of a child. Parents in Luxembourg may choose to take 4-20 (depending on whether that leave is full-time, part-time, or split between parents) months of parental leave until a child is 6 years old.

During this time, they can receive an allowance based on social security payments.

Tax Law and Social Security Contributions in Luxembourg

Income tax in Luxembourg is leveled progressively from 0-42%. The amount also depends on the marital and residency status of the employee.

Employers should expect to contribute to their employee’s social security an amount between 12.15-15.2% of their salary. Employee contributions are between 12.2-12.45%.

CONTACT US TODAY

FAQs

Expert EOR services are priced in Luxembourg as a percentage of a coworker’s monthly salary. This cost covers all HR duties necessary to guarantee adherence to all regional employment laws.

It is safe, legal, and effective to manage employer duties through an EOR in Luxembourg without the need for a specific organizational structure there. EOR services achieve this by retaining excellent HR support and engaging local legal experts.

Your team members will be totally protected by the law, get accurate and timely monthly payments, and have access to all employee benefits in Luxembourg if you use an EOR service agreement.

Independent contractors working inside a Luxembourg EOR framework may be qualified for some or all of the same benefits as regular employees while maintaining complete control over their work. This is the same as what contractors in Luxembourg would get if they were working with an umbrella company.

By employing their extensive professional networks, in-depth understanding of local business resources and benchmarks, and a firm dedication to ethical hiring processes, our team of recruiting consultants can locate the best local talent in Luxembourg for your requirements.

As a result, integrating these new recruits into our Luxembourg EOR system will be simpler and more efficient than when they were hired through more traditional hiring practices.

Through INS Global, you receive comprehensive compliance-assured employment outsourcing assistance from a truly international EOR services provider. This follows all applicable national, state, and municipal laws meaning you have access to the whole country.

It’s possible that specific PEO or EOR service providers in Luxembourg have stringent hiring standards or a cap on the number of workers you may hire at once. However, INS Global is aware that depending on your global company plan, you could need to scale up or down quickly. Working with us gives you the flexibility to hire as few or as many individuals as you need to reach your objectives.

Payroll expenses, hiring fees, signing bonuses, and other direct and indirect costs like incentive schemes, handling the taxes of international workers, and social insurance should all be taken into consideration as part of the hiring cost in Luxembourg.

By doing away with the requirement for a local site, using Luxembourg PEO services allows you to circumvent time-sensitive incorporation laws.

Giving your employees a choice to work in a shared workspace or the freedom to do so whenever and wherever it’s most convenient is still a good idea, and INS Global can also provide advice on the best ways to offer this.

Absolutely. We can handle the essential changes, such as visa and work permit procedures if Luxembourg citizens or foreigners are subject to various local employment rules, tax legislation, or employee perks.

For companies of all sizes, from SMEs to multinational corporations, the best EOR and PEO solutions are available to enable the effective and secure employment of foreign or local workers. If more workers are needed, our services can readily scale up to meet that need, and they can even take the place of more complicated internal HR requirements.

Businesses in a variety of industries that either don’t have their own structures in a target country (or desire to avoid cost-scaling issues while focusing on expansion) would benefit greatly from the legal expertise offered by PEO and EOR services.

Two alternative third parties that can be used to directly or indirectly hire independent contractors are staffing companies and umbrella businesses.

The majority of independent contractors in Luxembourg work for themselves or own their own small enterprises. According to Luxembourg law, labor agreements, not employment contracts, must be used when hiring contractors.

Before the job begins, an independent contractor might be required to provide a CV, portfolio, verified references, and a signed NDA.

Employers in Luxembourg typically organize payroll monthly, with deductions for tax and social security contributions made at source.

Monthly minimum wages in Luxembourg differ for skilled and unskilled labor, and both are amended frequently. The current minimum for skilled workers is EUR 3.009,88 per month, while unskilled workers must receive at least EUR 2.508,24.

Citizens of most EU and EFTA states can live and work in Luxembourg without requiring additional paperwork. For citizens of other countries, the most common work visa type is the Salaried Worker Visa. These are available to those who already have a job in Luxembourg and require the employer to handle most of the process. They can take several weeks to arrange, and are available for 1 year at a time, with the option for 3 years’ renewal.

Additionally, workers can apply for a Highly Qualified Worker Visa, also known as an EU Blue Card. These are valid for up to 4 years and allow the holder to live and work across the EU. However, the application requirements remain high.

In Luxembourg, employers retain and manage taxes on behalf of their employees. They are also required to provide contributions to the employees‘ social security funds. These funds cover health insurance, pensions, and other forms of health benefits. The employer contribution amount is equivalent to 12.22-15.75% of the employee‘s salary.

All employees in Luxembourg are eligible for the usual benefits of paid leave, health and medical insurance, a pension, and unemployment insurance. In addition, many employers in Luxembourg provide supplementary benefits, including travel allowances, meal vouchers, and additional paid leave.

Employers in Luxembourg can amend employment contracts with written notification of any changes being provided to the employee if the change will negatively impact the workers‘ conditions. Changes resulting in a positive change may be applied without notice. Some worker types are protected against any negative changes to their contracts without prior agreement.

All employees in Luxembourg are eligible for basic medical treatment through the public healthcare system, called the La Caisse Nationale de Santé/Gesondheetskees – CNS. Users pay around 10-20% for most treatments, with the rest being paid through social insurance funds. Access to further services and specialists requires further payment, for which many employers offer supplementary health insurance packages.

All employees in Luxembourg are eligible for severance pay except in cases of gross misconduct.

Severance and notice in Luxembourg depend on the length of the employee’s service with the company. Notice periods begin at 2 months notice and increase to a maximum of 6 months.

Severance starts with a minimum of 5 years of service, providing 1 month’s standard salary. This amount increases to a maximum of 12 months’ salary after 30 years of service.

The Ministry of Labor and Employment is in charge of overseeing much of the country‘s employment legislation, with the Labor and Mines Inspectorate investigating and various national Labor Courts judging on matters of dispute.

There are 11 public holidays per year on which employees are eligible for paid leave if the day falls on a typical work day. Workers are eligible for an additional day off if the public holiday falls on a Sunday or other rest day.