Unexpected unemployment can occur, particularly in times of uncertainty. Companies must sometimes reduce operation costs, including staff wages, utilities, resources, employment tax, and other extra expenses. In these cases, the employer must provide a written termination notice when terminating an employee’s contract without reason. The company has to compensate severance pay in Thailand according to the duration of continuous service.

Here, we go over some of the most important information companies have to know when considering employee termination or severance packages in Thailand. We look at what an employee is entitled to, as well as how a business can protect itself.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

In a hurry? Save this article as a PDF

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

Fill up the form below 👇🏼

How Can Companies Terminate Employees in Thailand Successfully?

Besides government administration and state businesses, workers and organizations in Thailand are subject to the laws outlined in the Thai LPA of 1998.

A worker or an employer may terminate an employment agreement by providing the other party with written notice. Unless a contract specifies otherwise, the due date for this is usually one month before termination.

A company seeking to terminate an agreement immediately and without prior notice must pay income in lieu of notice.

When dismissing workers without reason or attempting to withhold payments, the odds of employees submitting an unfair termination claim to the labor court are high. In these cases, a company should be careful as fines or settlement payments will likely outweigh any initial amount of severance.

If a company terminates an employee’s contract because of severe misconduct, prior notice or pay in lieu is not necessary.

Exceptions to Making Severance Payments in Thailand

A business is not obligated to offer severance pay to a worker whose work has been terminated, according to Section 119 of the LPA. These circumstances include a worker:

- Dishonestly performing tasks or committing a serious crime against the business.

- Causing harm to the company.

- Committing acts that result in severe consequences for the employer.

- Working in breach of the company’s organizational policies and procedures (including times when the business has already issued the worker with previous written notice).

- Failing to fulfill responsibilities for 3 consecutive working days without reason.

- Being sentenced to be imprisoned by a final court decision.

How to Terminate an Indefinite Contract in Thailand

Prior notice of termination is mandatory in indefinite contracts unless the dismissal is for reasonable cause. These reasonable causes can include things like gross misconduct or provable breach of contract. Here, it’s still advised to seek legal advice when making decisions.

According to the current LPA, when an employer terminates a workers like this, they do not have to provide the lawfully required notice if they choose to settle by offering payment in lieu of notice.

The legislation also mandates that employers provide notice of payment installments on the effective termination date.

What are the Types of Severance Pay in Thailand?

Standard Severance Pay

Special Severance Pay

Employee compensation around dismissal due to a unique situation specified in the Labor Protection Act (LPA).

Special circumstances:

- Relocation (Section 120)

If a company relocates, affecting the worker’s lifestyle, the employer should notify the employee at least 30 days before transferring.

Should workers decide not to relocate, the employee may terminate the contract within 30 days of obtaining the transfer notification. In this case, the employee is eligible for special and regular severance pay.

- Workplace, production, distribution, or service performance enhancements (section 121)

The employer must notify the labor inspector at least 60 days before the termination date. It is important to notify them that the termination is due to technological or mechanical advancements. The following is the information that needs to be provided:

- The details of the employees to be dismissed

- The date of the dismissals of employment

- Explanations for employee dismissal

Is Severance Pay Taxed in Thailand?

In the Case that Severance Pay Is Obtained As a Result of Being Laid Off or Dismissed:

The first 300,000 baht (USD 8,326) of severance pay is not subject to Thailand’s severance pay tax. Individual income tax is imposed on amounts exceeding THB 300,000, or the total of 10 months’ income. The company has to withhold the correct amount of earned income on behalf of the employee as part of the usual payroll tax process.

Moreover, people with 5 tax years of employment or more with a company might be eligible for a special deduction. It is a “one-time payment” per Section 48 (5) of the Revenue Code.

Special Deductions For a One-Time Payment:

Employees working for an organization for 5 years or more before termination are eligible for a special tax reduction. It would count for a one-time payment, such as severance pay.

Two added expenses are excluded as tax credit from the worker’s salary when the company calculates the personal income tax to be withdrawn. As per the steps below:

Step 1

Expenses on this salary are permitted at a value equal to THB 7,000 x the number of years worked. However, this cannot be higher than the employee’s standard income.

Step 2

Additional expenses may constitute 50% of the remaining amount.

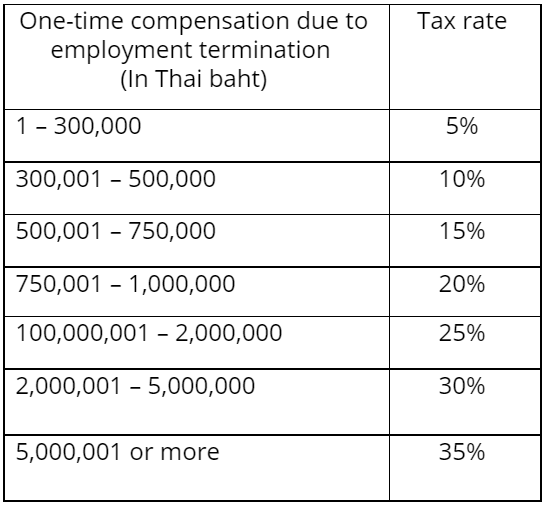

As shown below, the Thai personal income tax rate may be subject to the following special deductions:

How About Severance Pay From Retirement in Thailand ?

Calculating the employee’s final tax payments must include the entire severance pay deduction.

How Is Severance Pay Calculated in Thailand?

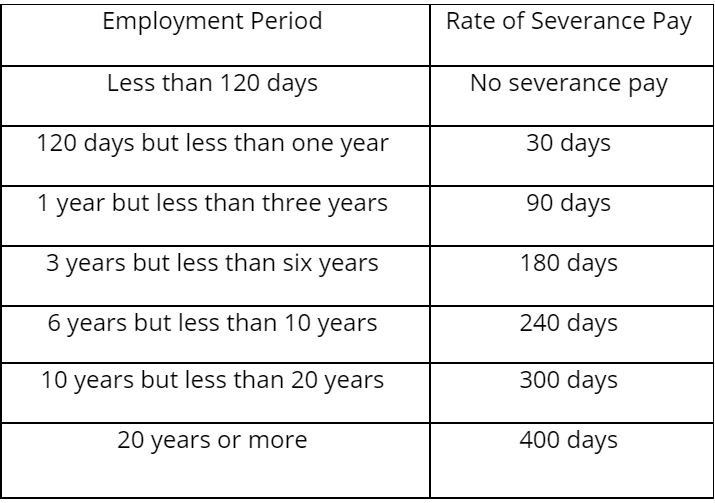

Severance Pay Rates in Thailand

On May 5, 2019, the latest Labor Protection Act (No.7) B.E. 2562 (2019) went into effect. This change to the LPA raises required severance pay amounts for employees who have been with a company for 20 years or more.

Severance pay in Thailand depends on pay for each year of employment as follows:

Optimize Your Employee Management with INS Global

Maintaining an entity in Thailand is not necessarily the best way to employ workers within the country. Without the right expertise, it can quickly become a lengthy and costly process.

Instead, recruitment through a Professional Employer Organization (PEO) is a more efficient strategy when planning business in foreign markets. PEO services help you expand quickly and fearlessly in as little as 48 hours.

Experts in global mobility can offer HR services outsourcing to streamline your expansion plans with no extra hassle. From signing employment contracts overseas to making tax returns, a PEO offers human resource experts to guide you through the toughest parts of global operations.

INS Global recruits talent on your behalf, outsourcing them lawfully through our local entity in full compliance with Thai labor laws. We carry the responsibility of compliance going forward, and these professionals can begin working for your firm within days.

SHARE