- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

INS Global provides global PEO (Professional Employer Organization) and Employer of Record (EOR) services in over 80 countries for companies looking to enter new markets and avoid the hassle that overseas expansion usually involves.

Like an international EOR, a PEO (Professional Employer Organization) provides companies with a way to simply and securely expand their operations overseas by outsourcing critical HR services to a third-party provider like INS Global. With a PEO in Saudi Arabia, companies can office compliance assurance to employees worldwide in less than 72 hours.

When businesses need support throughout the global expansion process, an Employer of Record (EOR) in Saudi Arabia offers cost-effective utility by taking care of employer responsibilities. Hire or transfer employees in markets worldwide in a fraction of the time of traditional methods with INS Global’s innovative employment outsourcing solution

With a PEO as your partner, you can transfer or hire employees much faster than with traditional company incorporation.

A PEO has legal experts whose knowledge and guidance will assist you when dealing with an unfamiliar legal system

Spend a fraction of the time and a fraction of the cost for expansion by using a PEO to help you get set up in the new country in just a few days

Let your PEO service provider handle all aspects of hiring and HR so you can focus on planning and achieving company growth

Pay a single monthly service fee and save thousands annually

With just one point of contact, you can have all of your HR needs met by professional specialists

Starting your operations in a new country is not an easy process; you might find yourself having to pay high fees or fines as a result of making even the simplest errors. However, a PEO or EOR service provider can help you avoid costly mistakes and put you on the fast track toward growth and success in the new market.

These two services are similar, but they still have some crucial differences. Before you partner with them, it is important that you understand how each one operates in relation to you and your employees:

Written contracts are not mandatory in Saudi Arabia but it is strongly recommended to write out all details of employment and compensation for the employee. Contracts should be written in Arabic with all salary amounts in Saudi riyal.

Probation periods are typically 90 days but can be extended for 90 more if both parties agree.

Work hours that extend beyond 40 hours a week are counted as overtime and must be compensated at 150% of regular wages. During Ramadan, the weekly hours for Muslim employees are reduced to 36 hours a week.

Annual public holidays in Saudi Arabia include two important festivals in the Islamic calendar, Eid Al Fitr and Eid al Adha. The date of these festivals varies each year slightly. 21 days of paid leave annually is the minimum; after 5 years, this number is raised to 30 days. Unused leave days can be carried over to the next year.

Employees are entitled to four months total of sick leave. In the first 30 days, they will receive 100% of their salary; for an additional 60 days, they receive 60%; and then after this another 30 days of unpaid sick leave.

Female employees receive 10 weeks of paid maternity leave. Mothers are compensated at 50% of regular wages during this time if they have worked for the employer for a year prior to leave, and 100% if they have worked for three years.

Paid paternity leave is three days.

The rate for corporate income tax is 20%. There is no personal income tax on individual income in Saudi Arabia.

Employers in Saudi Arabia are expected to pay social security taxes for their employees; this amount varies but can be averaged at 10%. Employers also pay 2% towards occupational hazard insurance.

No, it is necessary to use a local entity abroad to comply with each country labor law.

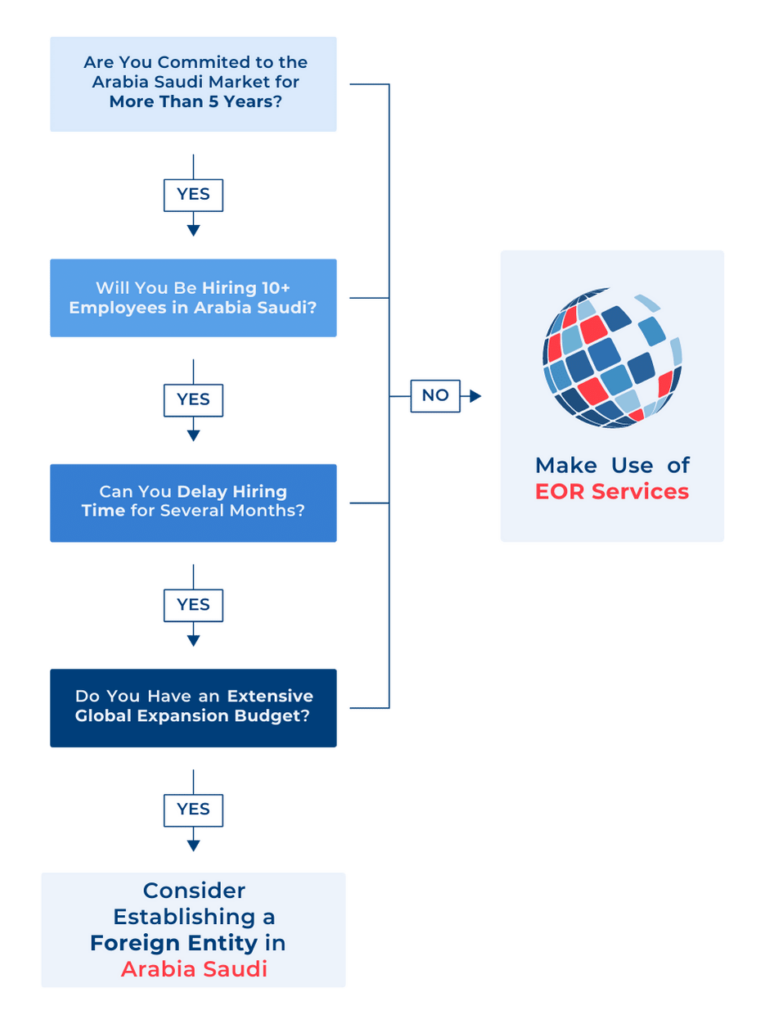

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

Level 39, Marina Bay

Financial Centre Tower 2,

10 Marina Boulevard

Singapore 018983